Why is Panama Company friendly for Cryptocurrency business?

1. Tax Advantages

Panama offers tax exemption policies for foreign source income. They do not tax income that is earned outside of its borders, including income from cryptocurrency trading or investments.

Furthermore, there is no capital gains tax on crypto-related transactions. This unique tax system has attracted crypto investors from all over the world, as it allows them to retain more of their profits, making Panama a highly attractive jurisdiction for cryptocurrency businesses.

2. Stable Economic

Panama enjoys a relatively stable economy and has been growing steadily for years. The official currency of Panama is the U.S. dollar, and its use helps play a key role in maintaining low inflation and stable prices. As a result, Panama has become an economically attractive location for foreign investment.

With a stable economy, and a favorable legal framework, Panama has created a secure environment for businesses that are involved in cryptocurrency transactions and investments.

3. Legal framework for crypto currency

Panama is known for its favorable legal environment, especially regulations for the cryptocurrency sector. This country does not impose strict regulations on cryptocurrency, allowing businesses and investors to use and trade digital currencies more freely. There are no formal licensing requirements for the businesses engaged in the cryptocurrency exchanges or wallet services operations.

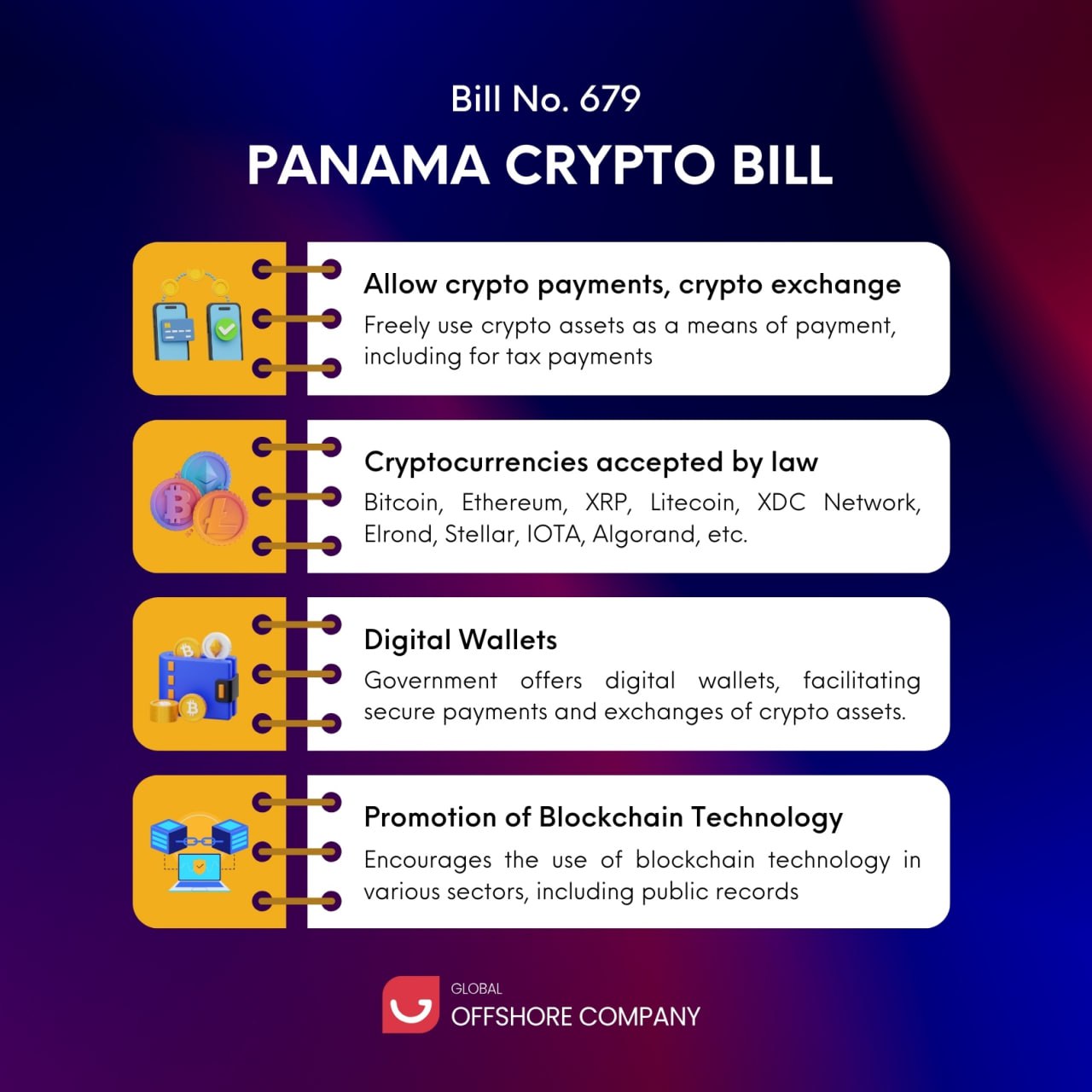

In 2021, Panama attracted attention with a bill No. 697, introduced to regulate cryptocurrency, highlighting the government's commitment to fostering the development of this sector. The bill aims to establish a legal framework for cryptocurrency, providing clarity and certainty for businesses engaging in the digital economy.

The bill also proposes guidelines for the issuance of digital assets. This could help Panama become a hub for Initial Coin Offerings (ICO) and other blockchain-based ventures. As a result, there will be more cryptocurrency investors and businesses entering the digital market in Panama.

Additionally, Panama's privacy laws also help attract many investors, especially those who value security in financial matters, including cryptocurrency businesses. However, these privacy protection measures are being monitored stricter by international organizations, particularly by the Financial Action Task Force (FATF), which forced Panama to strengthen its AML regulations. The compliance with global standards will help Panama prevent from being placed on discriminatory lists.

Therefore, there may be changes in the regulations in the future to address concerns related to financial transparency and the potential for money laundering through cryptocurrencies.

Conclusion

Along with the tax advantages of Panama, the increasing acceptance of cryptocurrency in the business, Panama has become one of the attractive destinations for cryptocurrency businesses who are seeking for the profitable investment opportunities.

In conclusion, Panama is still in the process of developing its cryptocurrency ecosystem. The country has the potential to become a leading destination for cryptocurrency businesses. To achieve this, Panama will have to implement thoughtful regulations to balance innovation with legal and financial integrity.

If you are interested in incorporating an offshore company in Panama, please do not hesitate to contact the G.O.C for further details.

%20(1).jpg)